Facial Recognition VS

Facial Verification

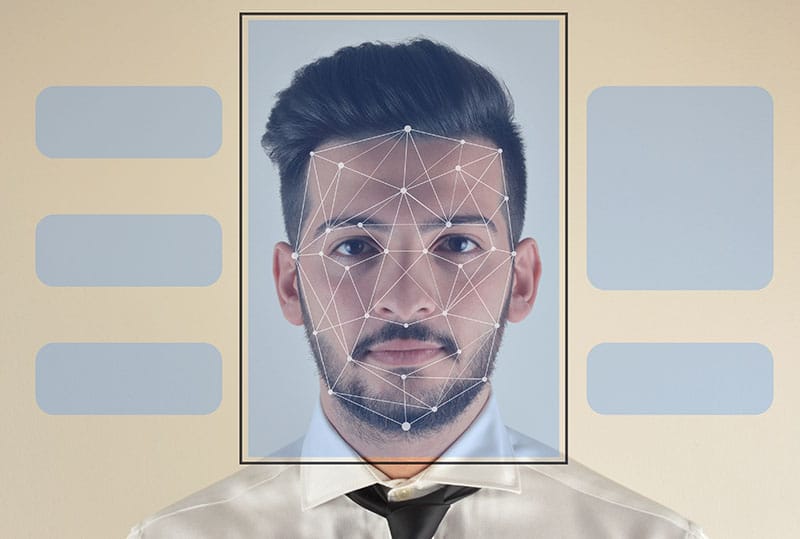

What's the difference between facial verification and facial recognition?

In recent years, facial biometric technology has taken an enormous leap forward. Businesses have recognised this and are embracing software that can provide accurate facial identity while also protecting their client’s personal data. There are two types of facial software applications that often get lumped together or are believed to be the same thing – however, that’s not the case.

Facial recognition and facial verification are two very different technologies and need to be considered separate from one another. To help you understand each product, let’s explain in more detail the difference between facial recognition and facial verification.

Facial Recognition and Facial Verification: How it works

To best explain how each technology works, here are two scenarios:

SCENARIO 1 – FACIAL RECOGNITION

You’re sitting in your seat at Optus Stadium, waiting for your favourite singer to perform. Facial recognition technology, combined with CCTV, is scanning the crowd to match faces against a database of known or suspected criminals. This is facial recognition.

SCENARIO 2 – FACIAL VERIFICATION

You’ve decided to become a first-time homeowner and purchase a house. You need to apply for a mortgage to pay for the new home. You log on to your bank via your laptop or mobile device, and you use the device camera to scan your driver’s license or passport to prove your identity and are then asked to scan your face to confirm that your physical face matches the one in the ID document provided.

Questions around the ethics of facial recognition are calling for clarity on its use and are matters for public discussion. However, facial verification is not the same thing.

Why do we need Facial Verification?

Traditionally, we verified our identity by walking into a bank or telecommunications store and handing over personal documentation to someone. That person is then tasked with verifying our identity by confirming a match between our physical face and the image displayed on the identification document.

In a digital world, where ‘in-store’ shopping is no longer necessary, the challenge lies in transferring facial verification of our identities into a seamless digital process.

The digitisation of Identity Verification

At Scantek, we specialise in identity verification, and part of this process includes facial verification. Our technology enables you to complete facial verification and confirm you are who you say you are from the comfort of your own home.

As a business owner, the facial verification app provides you with:

- The knowledge that the verification is taking place

- The knowledge the customer has willingly collaborated with the verification

- Assurance of security and privacy

Aside from correct data capture and ease of use, the security of data is equally as important.

Our technology requires no effort from the user. Moreover, facial verification provides security, safety, simplicity, and privacy in today’s digital world. It is distinctly different from facial recognition and should be treated as such.

If you’d like to find out more about our identity verification technology, contact Scantek today.