Identity Verification for Tax & Accounting Practitioners

Verification is our core business. Our sophisticated technology ecosystem supports a user-friendly interface for you and your clients, emphasizing identity verification for practitioners.

Going digital tightens Proof of Identity methods

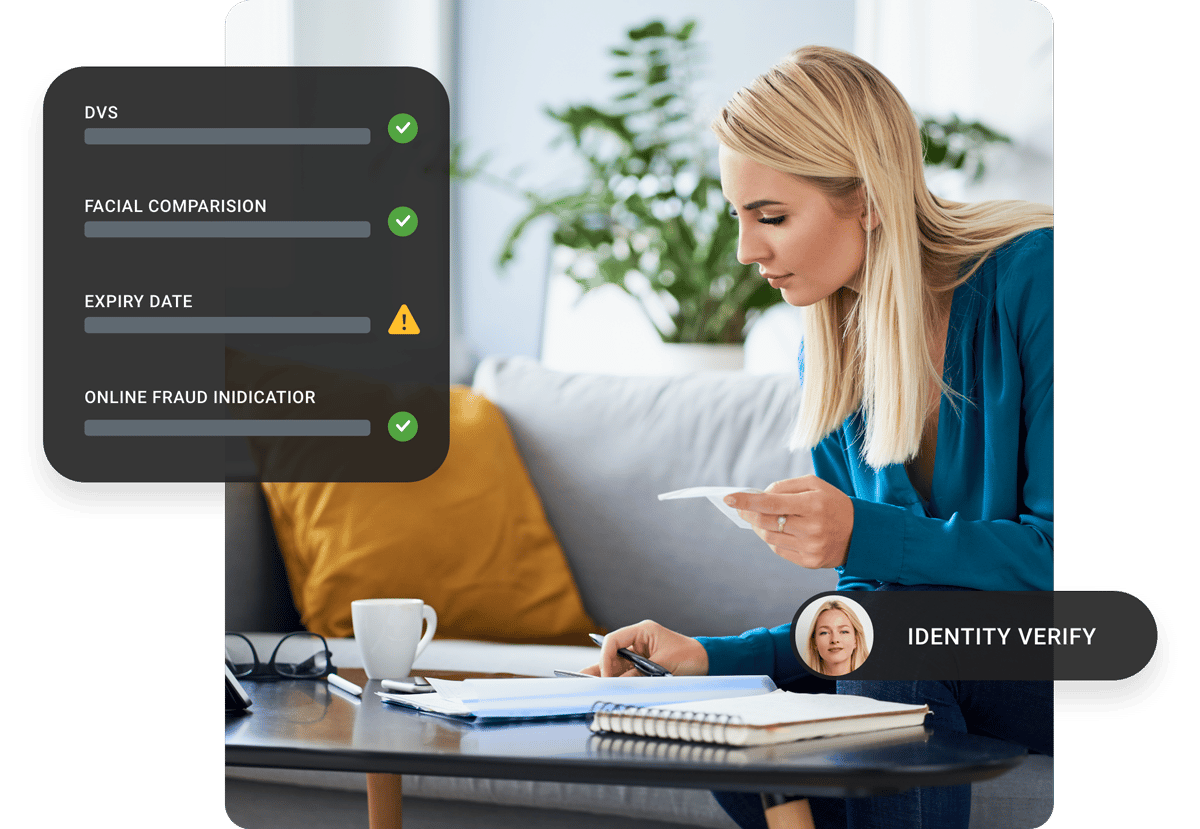

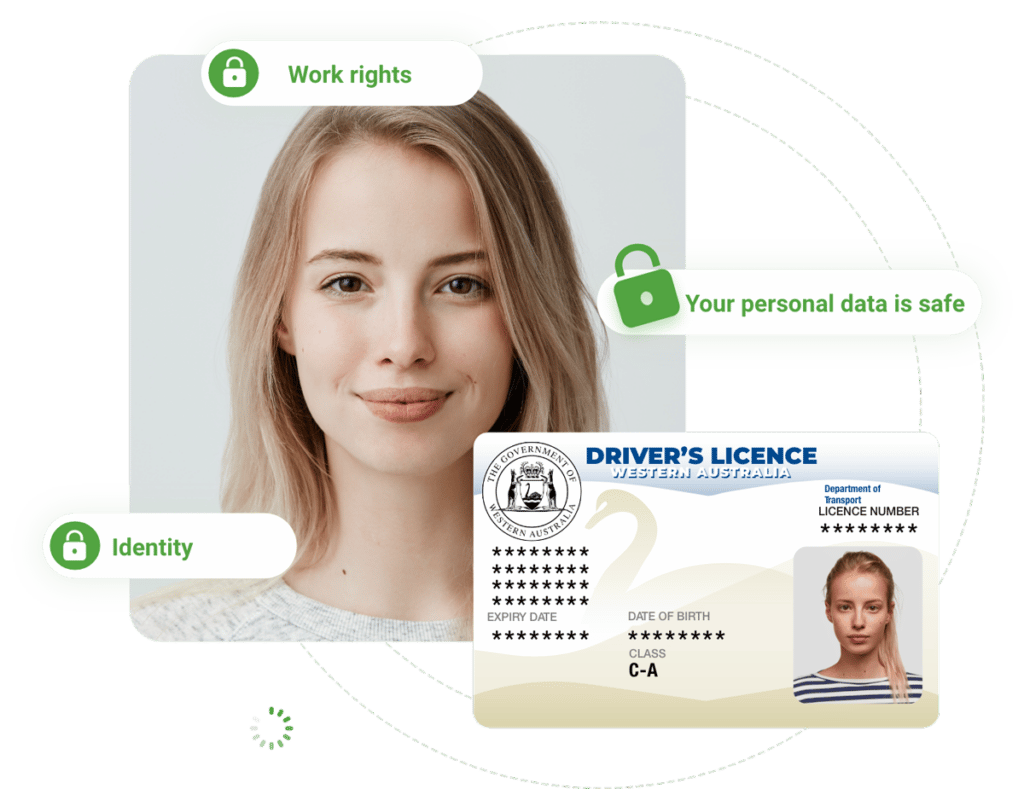

To protect your clients’ data when proving their identity, the process must be secure. A digital process enables use of advanced technology which outperforms manual processes. Scantek offers that secure digital option.

Our verification technology uses best practice in information security so that compliance with Proof of Identity regulations is easy, you can verify clients remotely with confidence and your clients’ personal information is protected.

Identity is a serious business

They’re not mandatory yet, but new guidelines from the Tax Practitioners Board (TPB) and Australian Tax Office (ATO) encourage you to transition to more secure Proof of Identity (POI) methods sooner rather than later. It’s not only to protect personal information but also to prevent the damage your business could suffer from data breaches or identity theft. Financial losses, operational setbacks, legal battles and reputational decline are negatives no business wishes to accrue.

It’s that serious.

But we’ve got a serious solution too. It harnesses the best of digital technology: An easy-to-use verification tool with endless capabilities.

Why digital Proof of Identity is important

Businesses that persist with manual verification methods not only incur greater costs, but leave themselves open to greater security risks. Digital solutions are an upgrade.

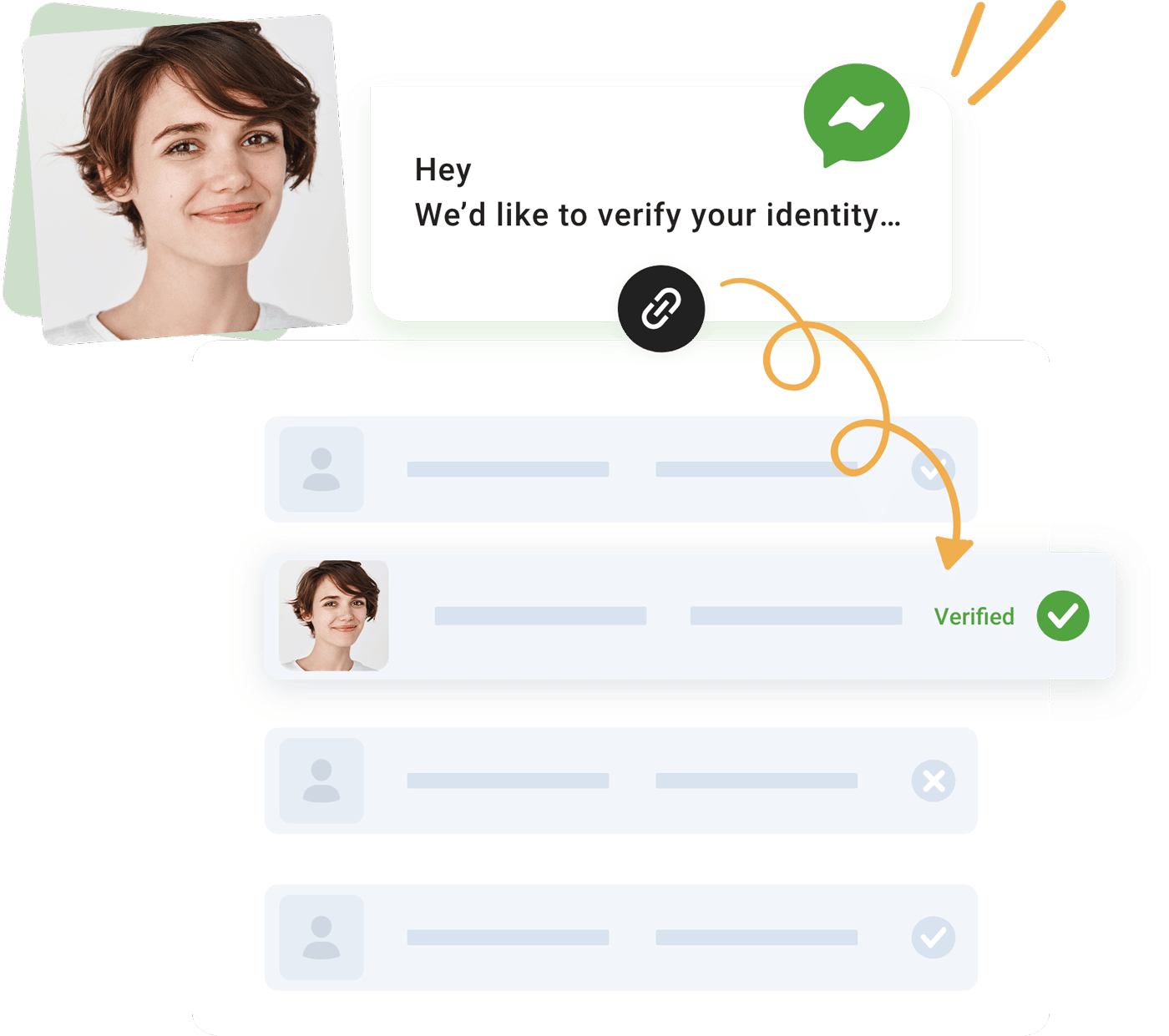

Remote connection

To remain competitive in the post-pandemic era, online work environments and remote connection are often essential. When distance means you can no longer verify clients in person, digital solutions are the obvious answer.

Our digital POI provides an accessible process that remains secure when in-person contact is not possible.

Regulator recommendations

The TPB ‘strongly recommends’ that documents for POI are only transported in these ways:

- via a secure online location, like a website, mailbox or secure messaging

- as an encrypted or password-protected email attachment

- via another secure electronic solution with minimal risk of being intercepted

Our digital POI completed through secure online architecture is far more protected than manual verification.

A worthy investment

- Digital verification and onboarding of clients is more efficient

- Automation saves your business time, cost and hassle

- Secure, cloud-based digital environments offer greater control and confidentiality of sensitive information

Our digital POI cuts through the administration and time costs of manual processes, and streamlines processes.

How Scantek Helps

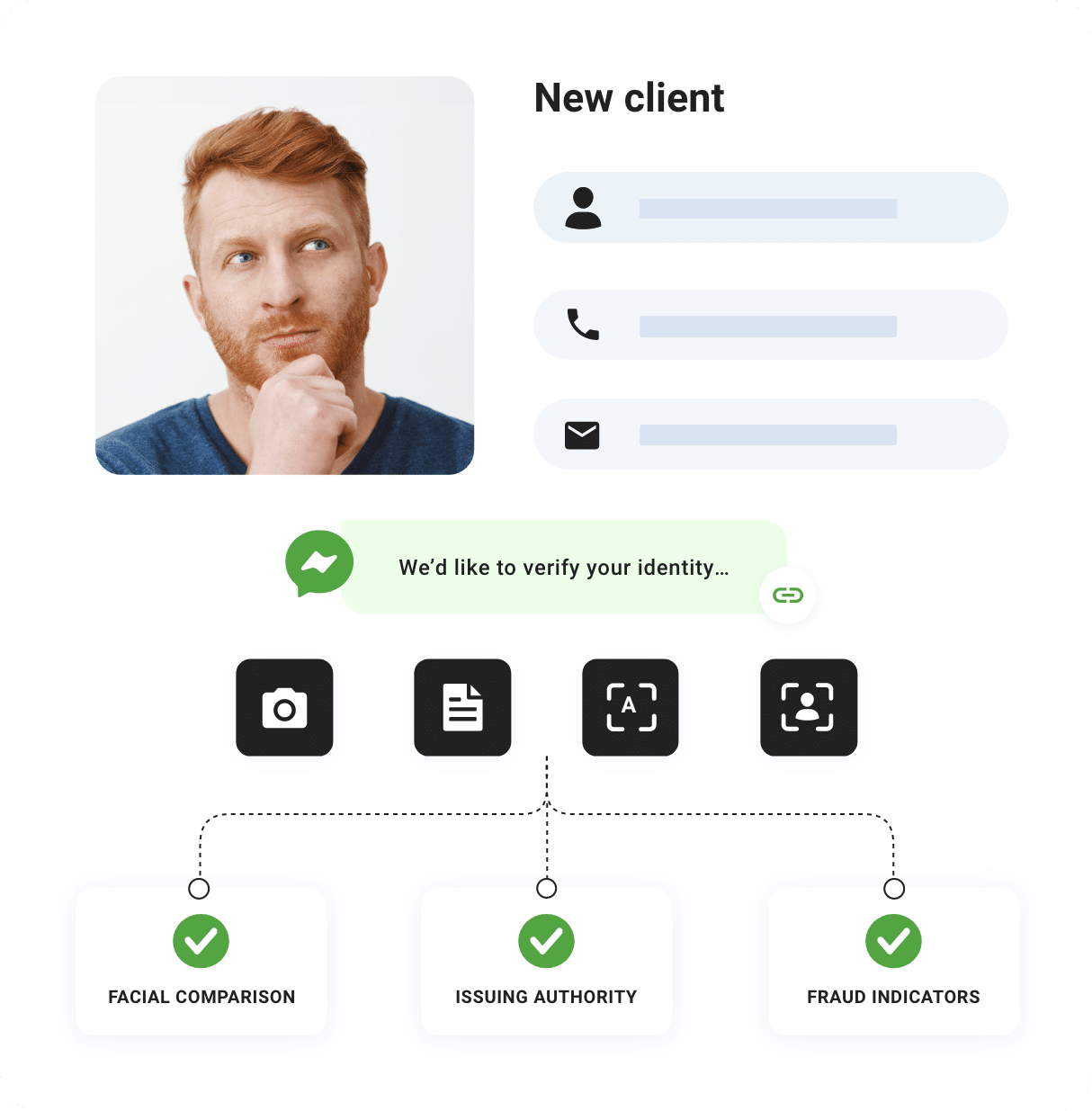

Digital Automation

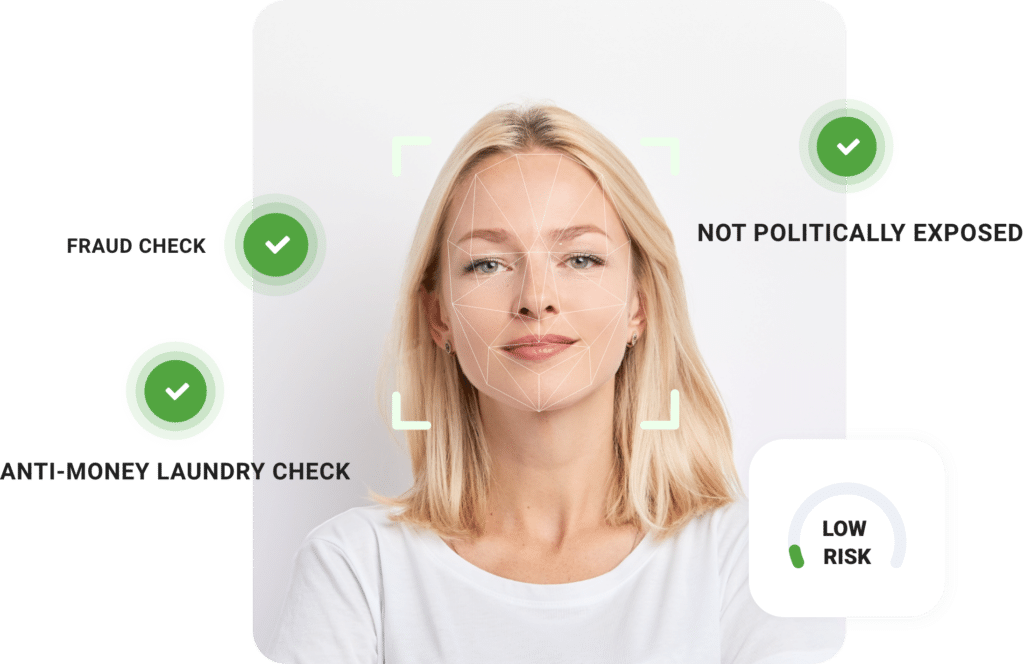

Speed and accuracy

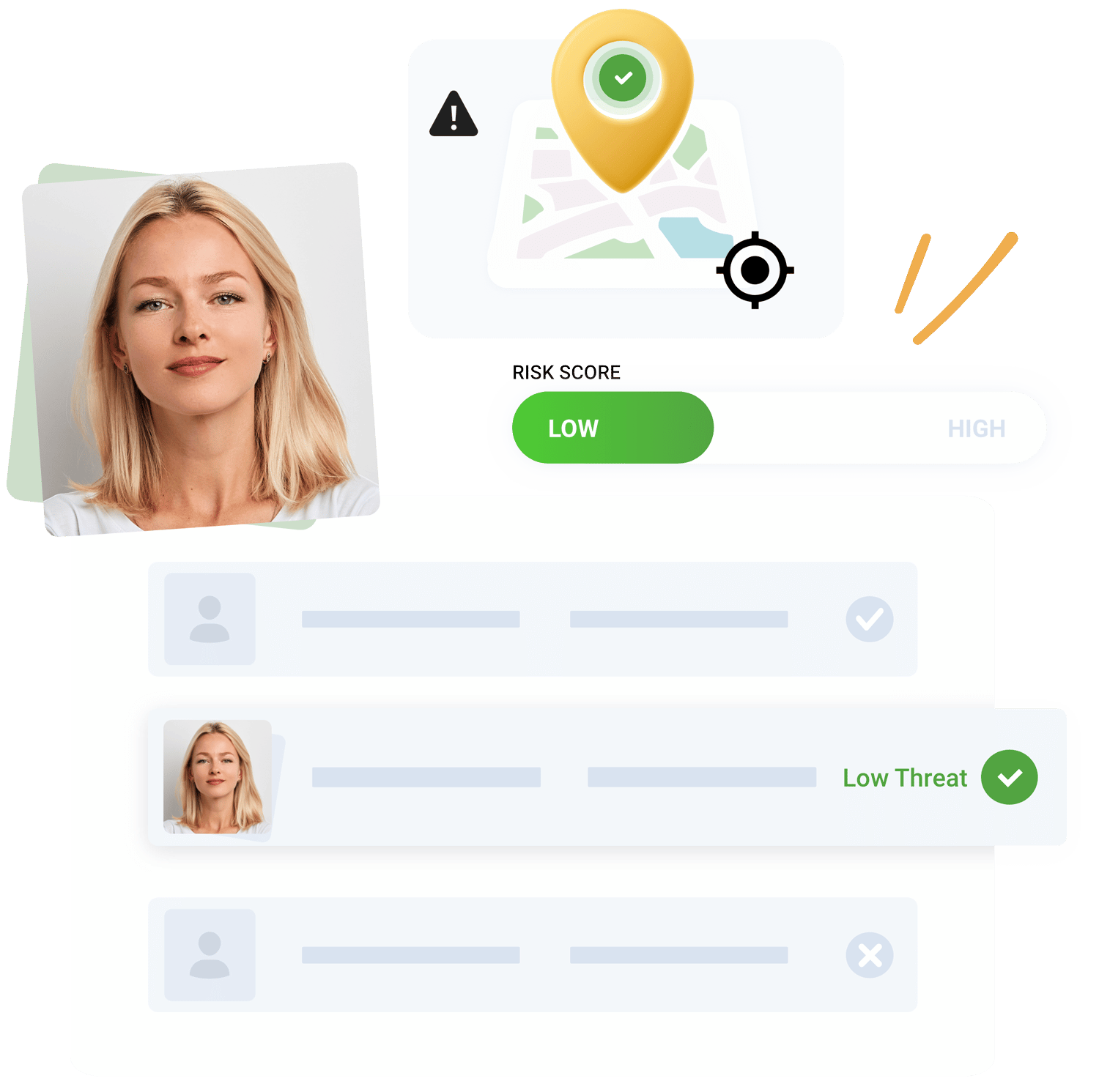

AI and machine learning enable thousands of micro-checks within seconds, with more precision than a trained human eye.

Boundaries dissolve

Your clients don’t need to visit an office or stand in queues. Using their smartphones they can complete their identity and document verification at a time and place that suits them.

Built-in compliance

Tax, accounting and bookkeeping compliance requirements are digitally integrated into your Scantek verification process, taking another action off your To Do list.

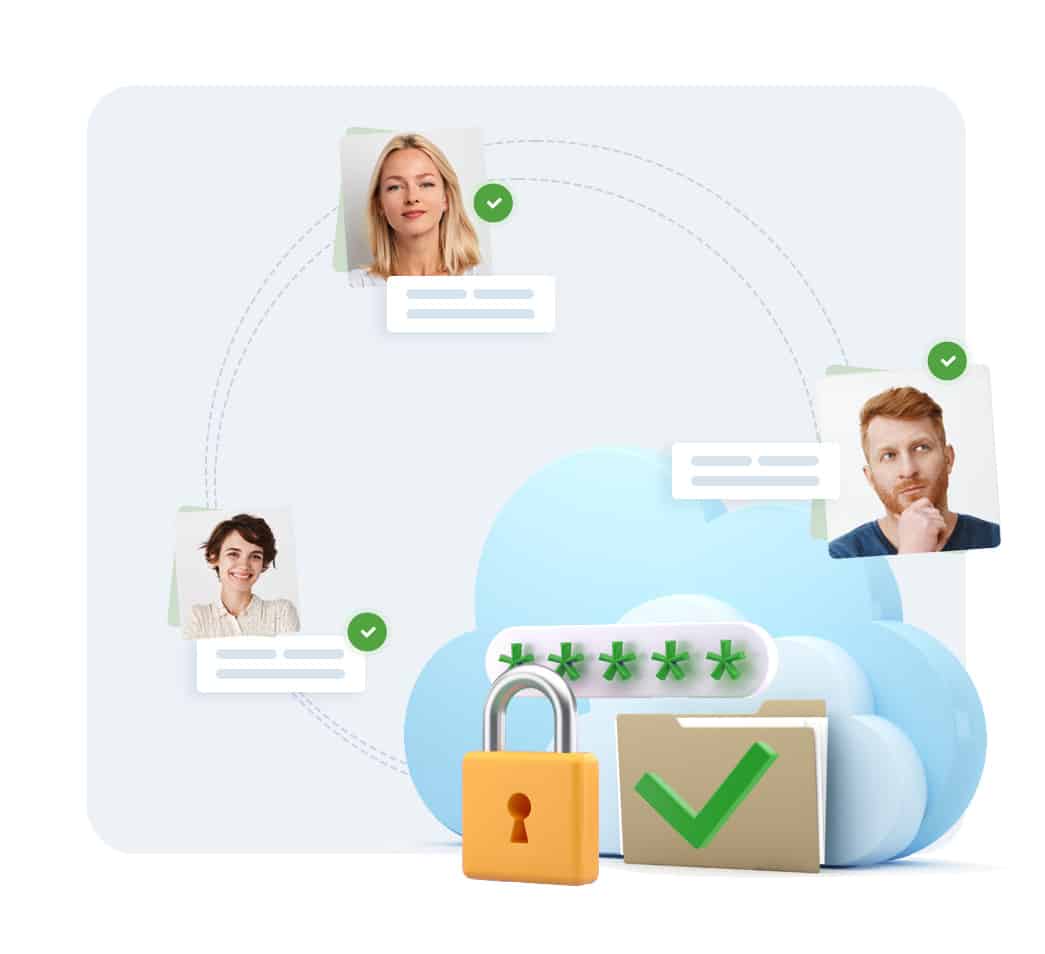

Data Protection

Cybercriminals dig for weak spots in your security framework. To block their access to sensitive customer information, your digital environment must be advanced enough to match a rapidly changing landscape.

We carry that responsibility for you. Your clients’ verification information is securely encrypted and safely stored in our environment. Scantek’s digital infrastructure has multiple layers of security built on zero-trust and privileged access principles. That eliminates risk to your business, even if your own system is breached.

Our ISO 27001 compliance means we provide the highest level of data protection and privacy in Australia. It’s the leading international standard on information security.

We’ve maintained compliance since 2018, and we’re externally audited every year to ensure we uphold best practices

Reporting

Client data shouldn’t be stored any longer than is necessary for verification, but regulatory bodies require you to have confirmation of POI steps taken.

The Scantek option of summary reports can be stored as evidence of due diligence in verification. These reports are trackable for auditing, with intuitive search functions. Where relevant, they show any other sources consulted for authentication.

Summary reports capture all information required by the TPB:

- date and time of the verification

- which documents were sighted and how

- confirmation that the sighted documents were clear and legible

- the final assessment and the basis on which decisions were made

Why Scantek?

Our desire to push technological boundaries is relentless.

Trailblazing Technology

The booming science and capability of machine learning and artificial intelligence are limitless. Our specialist engineers and data scientists remain at the leading edge of new developments, like:

- learning-based image processing

- advanced biometric technology

- automated data analysis and reporting

What you get is a product that outperforms human capabilities. And with every new verification, we’re learning more.

Secure data

You choose your preferred data storage method, whether it’s within our secure AWS cloud or your own data environment, and we make sure it remains private and safe.

Maintaining the global industry standard of ISO 27001 certification is our commitment to safeguarding the information you and your customer entrust to us. It also means we keep up to date with best practice on data integrity and confidentiality.

Affordability

No lock in contracts.

No need for administration staff.

No paperwork or stationery costs.

There are no phone calls to chase clients.

No fees for approved authenticators.

No frustrated clients.

Scantek takes care of every step in the POI process, so you can get on with business.

Ready to get started?

Our identity experts are available to talk through your requirements, answer questions and set up a demo.