Real estate transactions have historically been a favoured tool of money launderers and tax dodgers – now they are being targeted by identity thieves. Thankfully advancing technology also brings new tools to help conveyancers combat attempted property theft, and mitigate the risk of data breaches too.

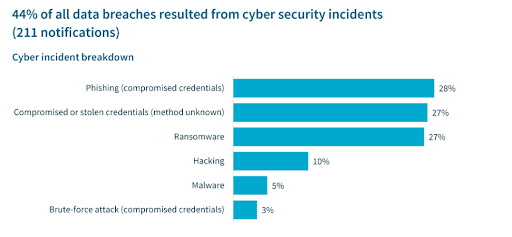

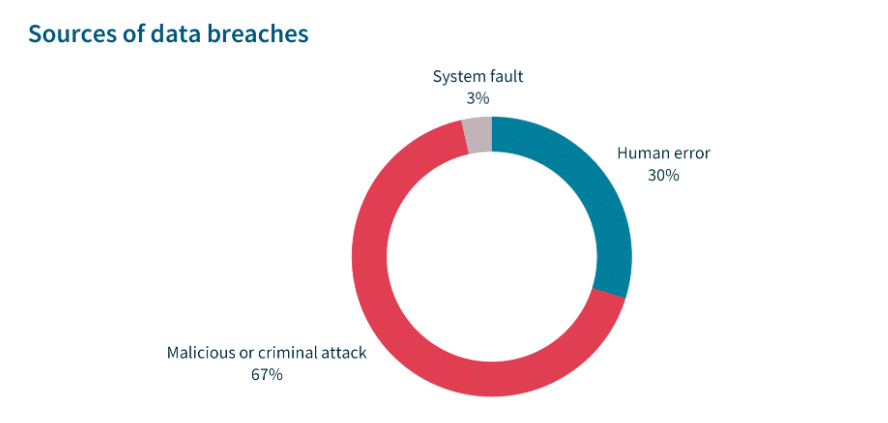

The high-profile data breaches of September 2022 exposed critical documents such as passports and driver's licences, shedding light on the inadequacies of our laws and protections concerning such breaches, and the many more data breaches that we don’t hear about.

Attorney-General Mark Dreyfus stated that the Document Verification Service (DVS) blocked over 300,000 fraudulent attempts to use stolen identity credentials in the aftermath of the 2022 data breaches.

Recently, The increase of “authentic” looking fake IDs has added to the challenge of identifying fraudulent documents, even when meeting clients in-person. To address this challenge, Scantek’s Digital Verification of Identity (VOI) solution, now includes In-Person VOI.

So, what makes our In-Person VOI solution such a powerful deterrent? The key lies in its principle of conducting back-to-source checks and advanced facial biometrics technology.

"We're not simply sighting 'originals', making copies of the document and giving the green light anymore" explains one experienced agent. "We're now leveraging technology to make sure the person standing before us is who they claim to be."

Conducting in-person VOIs with Scantek enables secure capture of client documents, verification against official databases, and facial biometric comparisons. Our Australian data centers securely store a comprehensive audit report, generated using industry-leading encryption. This minimises risks for settlement agents, eliminating the need to use copiers and scanners that may also be putting them at risk and storing personally identifiable (PI) data on their premises or in vulnerable locations on their computer.

Multiple significant data breaches have shone a light on the vulnerabilities in the way we do things, revealing the urgent need for better protection and processes to be in place. With Scanteks In-person VOI solution, it’s not just about ‘adapting’ to these challenges but rather proactively countering them.

By integrating back-to-source checks and cutting edge facial biometric technology, we’re improving the standard of security in the settlement process. With every in-person verification of identity (VOI) undertaken, we are not just merely validating documents, rather we are choosing to actively mitigate the risk of fraudulent transactions and reinforce the integrity of the final stages of the real estate process.