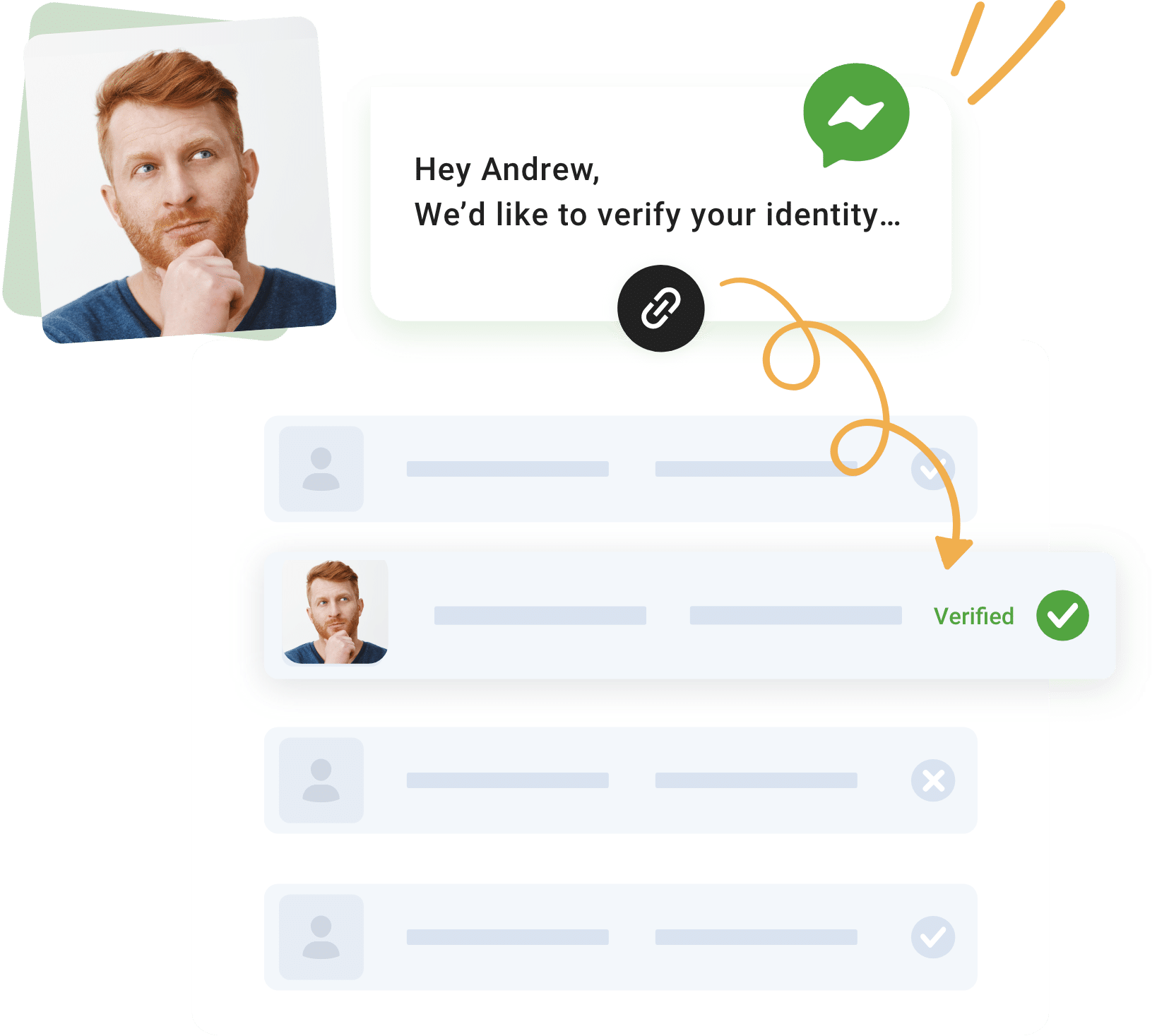

Instant Identity Verification

You’ll find many identity verification services, but few offer results within seconds. Scantek takes identity verification to the next level by automating it.

What is instant identity verification?

We use artificial intelligence to eliminate the need for a human to authenticate documents. Verification reports are instant, rather than taking hours or days.

If your business needs fast and accurate identity verification, Scantek’s user-friendly, secure technology is a multifaceted solution.

How can identity verification be instant?

It’s fully digital, that’s how.

Manual authentication needs a qualified person to check document discrepancies. In some cases that can take days, and accuracy is not 100% guaranteed.

Handling Poor Quality Documents in the Workplace

can delay the manual process and it may even need to start again.

We’ve taken advantage of artificial intelligence to move past slow manual methods.

As the science and capability of machine learning booms, our specialist engineers and data scientists remain at the leading edge of new developments. The outcome is a product which now outperforms human capabilities in both speed and accuracy. And with every new verification, it’s improving.

When does instant identity verification help?

Here’s when it becomes indispensable:

When time matters

The longer you keep customers or potential employees waiting, the more time they have to opt out and go elsewhere. Instant identity verification enables you to make speedy decisions for efficient onboarding.

When volume matters

If your business performs mass quantities of verifications daily, Scantek’s capacity to instantly process thousands of identities at a time gets more customers through your door.

When privacy matters

Our fully digital system means customer information is not passed to other people and our digital encryption keeps it secure.

3 strategic business advantages

1. Cut the cost of identity verification

Every verification performed manually costs money and has a lead time. By going fully digital, you’ll bypass administrative overheads, saving time and money.

You’re also assured of higher accuracy. Scantek’s sharp, built-in fraud detection helps you steer clear of financial damage caused by identity fraud.

2. Become a trusted business

Identity fraud hurts customer confidence levels as well as your bank account. Determining business risks in advance, like suspicious geographical location, is often more easily identified through data mining than human analysis. Being well-informed protects your business and your customers.

Our ISO 27001 accreditation certification in information security is another reason for customers to trust you. Scantek’s verification process maintains customer privacy because other people don’t view their details. All their information is digitally secure and never leaves the country.

3. Your customers will thank you

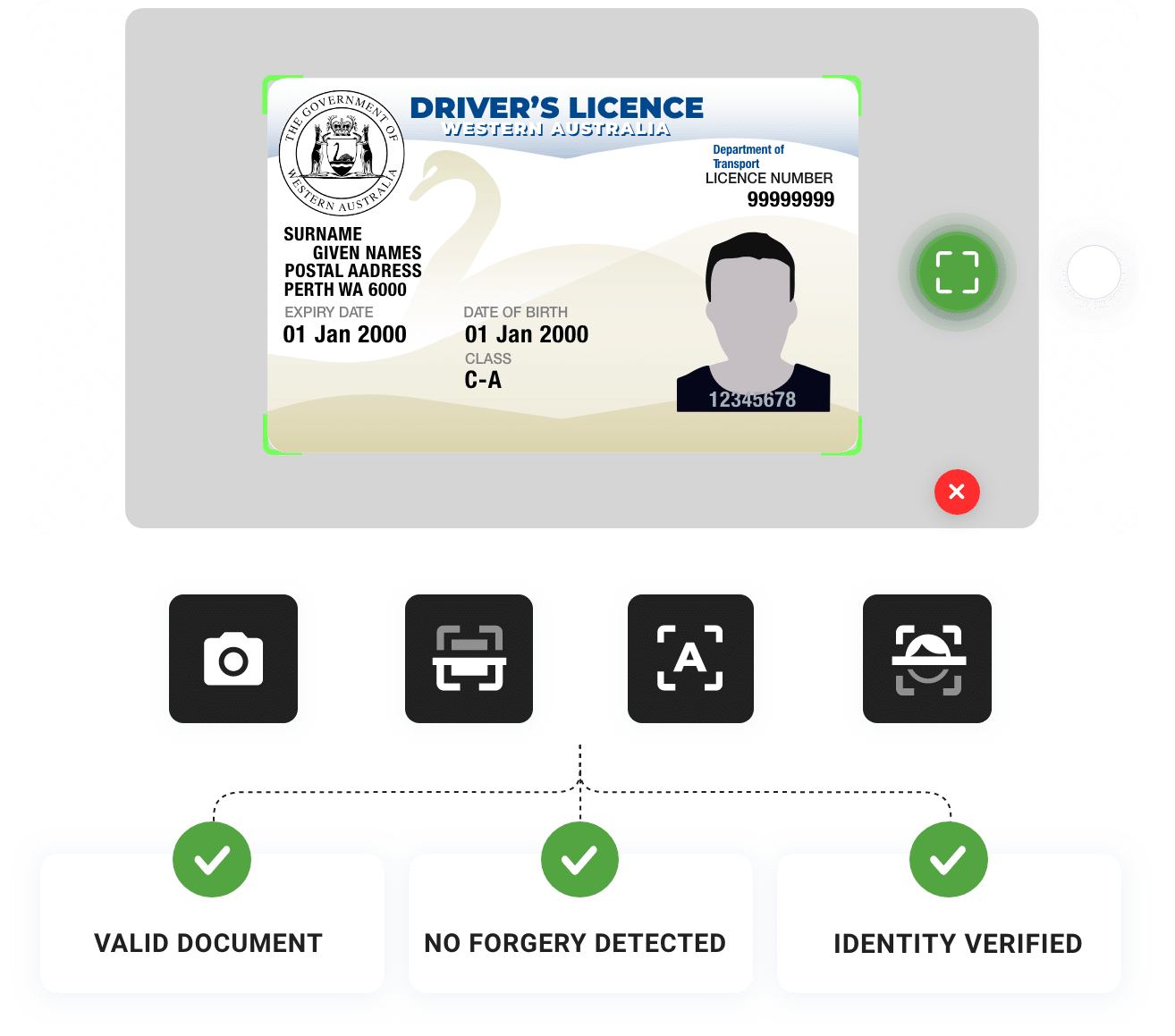

They’ll get it right first time. Technology using OCR (optical character recognition), with glare and blur adjustments for scanned images, ensures your customer’s screen captures are suitable for authentication.

Scantek makes it easy. Users can complete the process from their sofa. No appointments, no waiting, no hard copies of documents needed, and no delays.

How digital verification works

Instant document verification

Our app recognises thousands of local and international identity documents. OCR converts text on captured documents into a digitally readable format. Whether it’s handwritten or printed doesn’t matter—OCR uses several techniques to make sense of it. Once the text is converted to code, Scantek accesses our data verification sources to validate the document.

Instant facial recognition

Harnessing the capabilities of machine learning, which is a rapidly expanding branch of artificial intelligence, our recognition feature imitates human analysis. Comparing your customer’s selfie photograph with screen captures of documents, our technology uses algorithms to answer the question of identity, and you get a simple confidence percentage of the match.

Instant liveness detection

A guided sequence of head movements performed by your customer is a quick and easy last check. Sophisticated digital assessment of their real-time movement confirms they are really there and exposes recordings or fakes. It’s proven highly accurate, even when users wear a face mask or head covering.

Instant geolocation

Unlike photos supplied for manual authentication, digital images provide data on your customer’s geographical location. It’s a bonus check of the person’s place of residence as stated by their documents. Discrepancies, like the user being in a different country to their stated country of residence, can be queried.

What's the latest?

Find out the latest Instant Identification Verification news on the Scantek blog.

Ready to get started?

Our identity experts are available to talk through your requirements, answer questions and set up a demo.