Facial

Biometrics

Identification and Verification

Unlike other identification solutions, Biometric Facial Verification uses mathematical and dynamic patterns. The technology collects a set of unique biometric data of each person associated with their face and facial expression to identify, verify and/or authenticate a person. This innovative technology makes it one of the safest and most effective forms of Identity Verification.

At Scantek, we have developed a biometric solution based on facial recognition technology. Unlike other unsafe and non-reliable facial recognition solutions, Scantek uses AI algorithms and machine learning to offer total reliability while complying with the highest safety standards and the strictest regulations.

Biometric technology has evolved rapidly in recent years. Today, almost unknowingly, we interact with some form of biometric technology daily. Integrating biometrics into daily tasks, we harness their potential to enhance multiple facets of business operations.

Increase Security

Alternate security systems, like passwords, can easily be stolen or copied but the facial biometric system cannot be fooled. The system will match the facial features with a legal identity document, then ask the person to perform a liveness check.

Customer Experience

When onboarding a new customer you’ll need them to prove their identity. Often this is a two-step process which is both time consuming and not 100% secure. If the process is completed manually, this creates a potential for human error. Using Scantek’s technology will greatly improve your onboarding speed and accuracy as it takes only seconds to correctly identify a person and eliminates the need for human interaction.

Reduce Administrative & Operational Costs

Checking a customer’s identity manually or having a system that requires passwords all requires administration personnel. This may include people in your place of business or an offsite help centre assisting people to recover forgotten passwords. Scantek’s facial biometric system automates all security checks and eliminates unnecessary administration and operational costs.

Improve Audit Trails

Businesses, especially those involved in banking and finance, can use facial biometrics to improve audit trails. As a person’s identity is verified prior to a transaction, the details of that transaction, including time and place, are recorded. This removed the need for manual steps while also maintaining a compliant audit trail. Less manual intervention means faster transactions and an overall better experience for the customer.

Understanding the Facial Verification Process

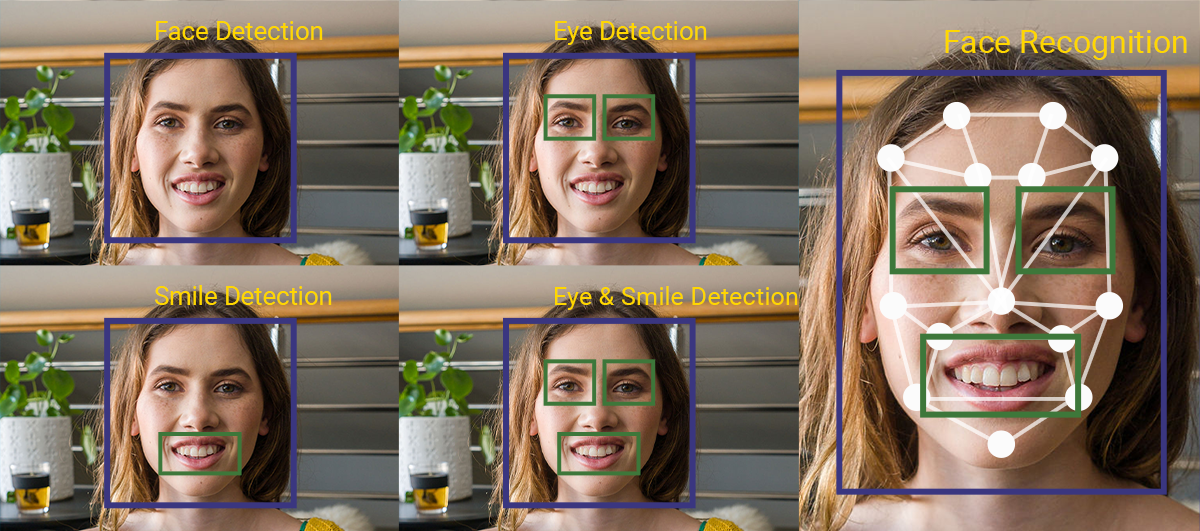

Verifying someone’s identity via their biometric traits (the face) involves four key steps.

Facial Detection

The person being verified is asked to take a selfie. Scantek’s biometric technology uses 3D sensors to detect their face from the surrounding environment.

Facial Analysis

The physical characteristics of your customer’s face are analysed. These include features like the distance between eyes and ears, and width of mouth.

Conversion To Data

Your customer’s image is converted into machine readable data using highly advanced algorithms. This creates your customer’s faceprint.

Facial Match

Mapping your customer’s data allows you to use it for matching against their identity documents and databases.

Greater Security Against Fraud

Facial biometrics is one of the safest forms of identity verification. The machine learning algorithms are continually evolving, making it even more difficult for fraudsters to steal your customer’s identity.

Selfie Authentication

Once the identity of your customer has been confirmed, they can use their face as a unique pass to access your services. Selfie authentication can be used for:

Verifying important transactions

Resetting forgotten access or passwords

Reauthenticated accounts on new devices

Applying for additional services or credit

Faster customer service

Ongoing, Accurate Fraud Detection and Prevention

Fraudsters are persistent and continue to look for opportunities to exploit businesses. That’s why Scantek offers an ongoing biometric fingerprint matching service.

Every time we undertake a new facial match, our system securely checks if that face has attempted to sign up to your service previously. If a match is found, our system alerts you to any suspicious activity, such as different identity information or an unusual location.

As with all Scantek products, these results are available in our secure cloud environment or via API/JSON directly to your solution.

These preventative solutions digitise the identity verification process and remove any chance of a paper trail or mishandling of information. This ensures the safety of your customer’s personal details.

FAQs

What is the difference between Facial Biometrics and Facial Verification?

We use facial biometrics, facial recognition, and facial verification to identify unique human facial characteristics. Facial verification matches an ID document with the customer’s identity in real time. Scanteks Liveness Check ensures the person in the picture is who they say they are.

How and where is the customer’s personal information stored?

Scantek encrypts any received information to ensure only designated people can access it. The process involves algorithms encrypting scanned data and creating a key for decryption. This entire process takes place in Australia, and all stored data remains within the country.

What industries benefit from Facial Biometric technology?

As more people choose to do business online, the industries using Facial Biometric technology is growing. Businesses who need to safeguard their assets and ensure their customers are genuine people will benefit from using the facial biometrics app. These can include businesses involved in finance, retail, gaming, telecommunications, hospitality, conveyancing and automotive.

Will Facial Biometrics improve my company’s customer service?

If you’re a business that requires your customer to prove their identity, you can either ask your customer to visit your place of work in person or adopt the technology that allows them to prove their identity from any location at any time. From a customer’s point of view, option two means less hassle, less delays and an overall better customer experience. Using the Facial Biometrics app is also much more accurate as it eliminates the chance of human error.

Ready to get started?

Our identity experts are available to talk through your requirements, answer questions and set up a demo.